We help investors create a better financial future by defining goals, developing plans, and implementing strategies to preserve their hard-earned capital and pursue steady, wise growth.

BUILDING IDEAL FUTURES

Weyhill has been building ideal futures for over a decade. For our clients that means providing confidence, while maximizing and protecting assets, in order to enhance their quality of life and provide for families or preferred charities. We understand that your vision of an ideal future is unique to you. For that reason, we provide a comprehensive suite of services that are customized to your specific needs. Collectively or individually our services are designed to help bring clarity, focus, and simplicity to your financial situation.

Financial Planning

Having a well-grounded, structured financial plan is one of the most important steps you can take in securing your ideal future. We start by helping you define goals, analyze and understand your current situation, and identify inconsistencies of your existing approach. From there, we develop a comprehensive written plan that more closely aligns your assets and financial decisions to your goals and aspirations. As a result, your finances will be organized and you’ll have peace of mind knowing that your savings, spending, cash flow, estate, tax, education funding, philanthropic, and insurance strategies are efficient, optimal, and focused on your ideal vision of the future.

Investment Management

Investment management is the core of our services. Our disciplined investment philosophy is structured around the latest academic research and based on Modern Portfolio Theory which removes emotion, mitigates risk, and captures global market returns. We begin with a thorough understanding of your goals, needs, risk preferences, tax situation, growth expectations, and liquidity requirements. We also take the time to educate you about the core components of our evidence-based investment strategy, and the scientific research in which it is grounded. We then develop a written Investment Policy Statement that sets forth the objectives, policies, and procedures for how the money is to be managed. The result is a customized, low cost investment portfolio that’s continuously monitored, rebalanced, and adjusted as economic conditions change and your financial affairs evolve.

Tax Management

We’re vigilant about tax awareness. Prudent tax planning can minimize both your current and future tax obligations, allowing you to accomplish your goals in the most tax-efficient manner possible. We help you develop strategies to reduce holding turnover, harvest losses, and optimally locate assets between qualified and nonqualified accounts to help create an extremely tax-efficient investment experience.

Retirement Income & Employee Benefit Analysis

We help you understand the value of the benefits afforded to you and develop ways to maximize and integrate them into your overall plan. Our analysis and recommendations include Social Security optimization strategies, 401(k) investment options and allocations, stock option exercise strategies, and Roth conversion analysis, among others.

Risk Management

Preserving and protecting the wealth that you’ve created is something we take seriously. We offer sophisticated solutions designed to insulate your wealth from the threat of litigation, taxation, or even family disputes. We review the types and amount of insurance you hold to ensure your policies are appropriate for your specific circumstances, and also recommend the ownership structures and beneficiary designations most beneficial to you and your family.

Employee Benefit Retirement Plan Solutions

In addition to the services Weyhill offers to individuals and families, Weyhill provides Retirement Plan Advisor and Consulting services to small and mid-size business entities. A high-quality retirement plan allows employers to recruit and retain valued employees. Our experienced team of retirement plan and investment experts deliver a hassle-free, low cost solution to retirement plan sponsors. As an ERISA Section 3(38) Investment Manager, employers and their officers can reduce their fiduciary liability by delegating investment selection and monitoring to Weyhill.

HOW WE CHARGE

At Weyhill, our fee structure is designed to be affordable and understandable. We believe in earning our keep, and therefore we’re compensated based on how well we manage your assets, not how often we trade or what products we use. No commissions or compensation of any kind are garnered through our investment decisions. Fee-only compensation allows us to remain impartial and deliver objective fiduciary advice that is completely aligned with yours – to maximize your wealth with the least amount of risk. We have a variety of fee structures available and we work with you to determine the most cost-effective means of delivering the services you need.

Individuals and Families

Investment Advisory Fees

Weyhill’s investment advisory fee is based on a percentage of the client’s total assets under Weyhill’s management ranging from 0.30% to 1.25%. Clients with $500,000 or more under Weyhill’s management will receive both financial planning and investment management services. Weyhill offers its investment management services programs pursuant to the following schedule:

Financial Planning and Consulting Fees

Financial planning and consulting services are offered on a stand-alone fixed project fee or on an hourly rate basis charged at $250/hour. The fee for financial planning and consulting services is based on the complexity of your situation and will be determined in advance of the engagement.

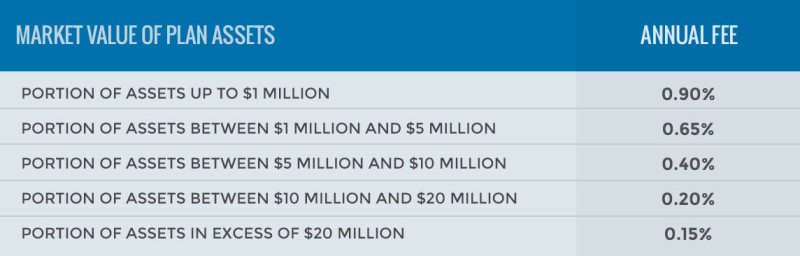

Retirement Plan Sponsors

Retirement Plan Advisor Services

Weyhill’s Retirement Plan Advisor Services is based on a percentage of the plan’s assets under Weyhill’s management ranging from 0.15% to 0.90%, pursuant to the following schedule:

Retirement Plan Consulting Services

Retirement Plan Consulting Services are offered on a stand-alone fixed project fee or on an hourly rate basis charged at $250/hour. The fee will be based on the size, scope, and nature of each individual project, and will be determined in advance of the engagement.